Real Estate Syndication: How to Pool Money for Large Investments

Real estate syndication represents a strategic avenue for investors seeking to capitalize on opportunities that may be unattainable independently. By pooling resources, investors can not only access larger, potentially more profitable properties but also share in the associated risks and rewards. This collaborative model fosters enhanced portfolio diversification and community engagement. However, navigating the complexities of syndication requires a clear understanding of the foundational principles and legal frameworks involved. What are the essential steps and considerations that can help ensure a successful partnership in this intricate investment landscape?

What Is Real Estate Syndication?

Real estate syndication is a strategic investment model that allows multiple investors to pool their resources for the acquisition and management of larger real estate assets than they could independently afford.

This approach enables participants to diversify their investment strategies while effectively addressing risk management.

Benefits of Syndicating Investments

Syndicating investments in real estate offers a multitude of advantages that can significantly enhance the overall investment experience.

By pooling resources, investors can achieve greater cash flow through larger property acquisitions, while also benefiting from risk diversification.

This strategic approach mitigates individual exposure and fosters collaborative decision-making, empowering investors to pursue opportunities that might otherwise be unattainable, thereby enhancing financial freedom.

Steps to Start Syndication

Starting a real estate syndication requires a methodical approach to ensure all legal, financial, and operational aspects are thoroughly addressed.

Begin by identifying potential investment opportunities and crafting detailed presentations to attract interest.

Focus on finding investors who share your vision and are aligned with your goals.

This strategic groundwork will lay the foundation for a successful syndication venture, fostering financial freedom for all parties involved.

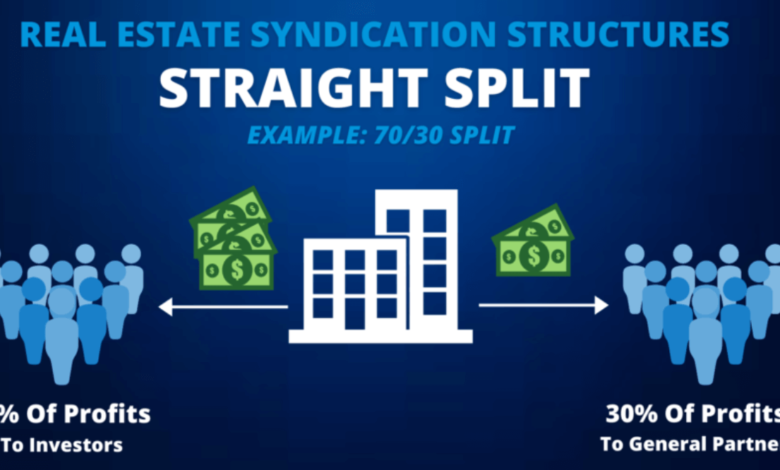

Legal Considerations and Structures

Navigating the legal landscape of real estate syndication is crucial for ensuring compliance and minimizing risks.

Understanding various syndication structures, such as LLCs and limited partnerships, is essential for attracting investors while adhering to compliance requirements.

Properly drafted operating agreements and securities regulations must be considered to protect all parties involved, fostering a transparent environment for collective investment endeavors and maximizing financial freedom.

Conclusion

Real estate syndication represents a strategic avenue for investors seeking to enhance their portfolios and mitigate risks. With approximately 90% of millionaires accumulating wealth through real estate investments, the collective approach of syndication becomes increasingly compelling. This method not only facilitates access to larger properties but also fosters collaboration among investors, promoting shared decision-making. As the real estate market continues to evolve, syndication emerges as a viable solution for achieving financial growth and independence.